If you are a beauty enthusiast who is curious about the state of the UK beauty industry in 2024, then no need to look further.

In this piece, we have organized, assessed, and classified some beauty industry statistics below.

Each category has been laid out for you. Keep reading for the top beauty industry statistics in the UK.

- General Beauty Industry Statistics

- Beauty Industry Statistics

- Makeup Industry Statistics

- Skincare Industry Statistics

- Cosmetic Industry Statistics

- UK Beauty Industry Statistics vs USA Beauty Industry Statistics

- UK Cosmetics Market Trends

- UK Cosmetics Market Analysis

- How Big is the UK Beauty Industry?

- How Much is the UK Beauty Industry Worth 2023?

- What Country has the Biggest Beauty Industry?

- What Demographic Spends the Most on Beauty?

NOTE

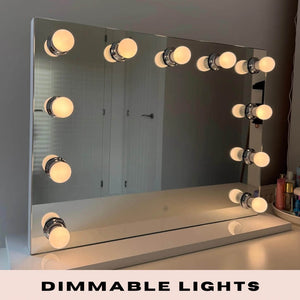

This article contains a collection of statistics gotten from various sources on different areas of the UK beauty industry trends and put together by Hollywood Mirrors, makers of dressing table mirrors and makeup vanity mirrors.

These are the results:

General Beauty Industry Statistics

Below are some general beauty industry statistics that show the behavior of people in the UK towards beauty.

- By 2027, the worldwide cosmetics market is projected to be worth $463.5 billion.

- The value of anti-aging products is anticipated to increase at a compound annual growth rate (CAGR) of 5.8% in the upcoming years, particularly those containing antioxidants like vitamins C and E. The anti-aging cosmetics market is projected to grow to $60.26 billion globally by 2026.

- Through 2024, the market for cosmetics containing CBD is projected to increase by $2.22 billion.

- Beauty Tech is the largest market segment, with a projected market volume of US$92,233,720,368,547,760.00 in 2023.

- Albania leads the world in revenue generation for the Beauty & Personal Care market, with a projected total of US$92,233,720,368,547,760.00 in 2023.

- According to 84% of responders, Dettol was the most popular health and beauty brand in the UK in 2021. Oral-B, Colgate, and Boots were also chosen.

- Shampoo sales led the UK haircare and beauty industry segment in 2020 with a market value of £470.5 million, hair colorants made £324.5 million, and conditioners with £315.8.

- In 2020, 73.9% of UK households shopped for Colgate products, 61.4% shopped for Nivea and 57.6% of households bought Dove.

- The fine female market fragrance in 2020, made £1 billion in market value and fine male fragrances made £554 million for the £945 million UK fragrance subsector.

- Over 50% of the UK's hair and beauty industry experienced an annual turnover of less than £99k in 2020.

- In 2020, the UK hairdressing, barbering, and beauty industry had more than 288.000 employees.

- The organic industry experienced a 10-year consecutive revenue growth of 13% between 2019 and 2020, making £13.8 million.

- 45% of British consumers use at least 1 organic product and 64% buy products with recyclable packages.

- In 2019, approximately 92,000 people worked in the UK beauty industry.

- People in the UK spent £8.6 billion at hairdressers and personal care salons in 2019. Each person spent an equivalent of £166 on personal care treatments yearly.

UK Beauty Industry Statistics

Everyone in the UK has a preferred behavior to beauty. Here is some beauty industry analysis that prove how they've interacted with this industry.

1: As of 2020, the UK's beauty industry worth is £27 billion and ranks as the seventh-largest global cosmetics market in the world. It holds the third spot for largest markets operating in the UK.

2: For 2021, the size of the beauty industry worth is placed at €9.8 billion by the European Cosmetic, Toiletry and Perfumery Data.

3: 38% of Brits said they don't spend money on beauty treatments and products, 33% spend £1–£15 per month (£12–£180 per year), 3% spend £51–£100 per month on their looks and 1% spend over £100.

4: Health and beauty spending in the UK will rise to 8.8 per cent by 2024, amounting to an additional £2 billion.

5: Due to the impact of COVID-19, 37.2 percent of consumers bought their health and beauty products online.

6: Prestige beauty sales fell by 24% due to the 2020 lockdown, in the first quarter of 2021 it rose by 33%.

7: The beauty market value of the UK natural and organic beauty industry in 2020 was £221 million. It is expected to reach £339 million by 2025.

8: Social media is instrumental to the growth of many beauty brands, as social influencers are used as part of strategies to increase exposure.

9: In 2018, beauty content on YouTube had a mesmerizing 169 billion views.

10: Yuya is the most popular beauty content creator on YouTube with over 24.8 million subscribers.

11: The most popular beauty brands on Instagram are Kylie Cosmetics with over 25.5 million followers, Anastasia Beverley Hills 19.5 million and Fenty Beauty 10.9 million.

12: Most popular beauty brands on Facebook are Bath & Body with over 10.37 million likes, Risqué 7.03 million and Mary Kay Brasil 6.08 million.

13: Vaseline was the most popular brand in the beauty industry in the UK in Q3 2021

14: In 2019, 94% of people who worked in the beauty industry were female. In 2020, 65% of beauty workers were self-employed, a 57% growth from 2019.

15: The presence of beauty brands on social media is essential. For example, people in the UK spend around 53 minutes a day just on Instagram .

16: Men's beauty industry size and growth are yet to reach their peak as more beauty brands tap into this market.

17: Having a personal hands-on experience with new beauty products is critical While beauty brands see digital e-commerce and digitally-enhanced in-store and virtual try-on apps as the wave of the future, a sizable percentage of beauty customers (41%) said they would not buy beauty products from beauty brands that they had only tried-on virtually.

Makeup Industry Statistics

These are the most prominent UK Makeup statistics you should look at.

- 6.8 million women recorded that they used foundation and tinted moisturizer at least once a day in 2020

- In 2020, an estimated number of 13.2 million people actively used lipstick.

- In 2020, 3.7 million people used Boots No.7 as the UK's most-used makeup brand. Rimmel and Max Factor were the second and third.

- The UK's most popular brand of highlighters and blushes in 2020 was Boots No7, purchased by 2.1 million people.

- In 2020 3.8 million people in the UK used Boots No7 lipstick and lipgloss products. Boots outsold both Rimmel and Maybelline.

- 3.7 million people in 2020 chose Boots No7’s makeup foundation, face powder, and tinted moisturizer.

- 35% of women buy makeup to subtly enhance their features, 12% to experiment with different looks, 7% to create a bold or dramatic look, 41% to conceal tiredness, 39% to cover blemishes, 25% to look youthful, and 22% (aged 16-24) to be camera ready.

- 83% of UK women wear makeup. The most preferred purchased products are mascara (57%), lipstick (49%), and liquid/cream foundation (46%).

- 29% of UK women have tried makeup trends like eyebrow defining. 69% of UK women say makeup trends are too time-consuming and 72% think the results are too unnatural.

- In 2019, 18% of people in the UK bought makeup once a month, while 3% bought it once a week.

Go here to see more uk makeup statistics, trends and facts

Skincare Industry Statistics

How much do Brits love their skin and just how much do you think they're willing to pay to take care of it? Find out in the stats below:

- The organic skincare market is projected to increase at an annual rate of 8.72% through 2027.

- By 2025, skincare sales are expected to reach $177 billion.

- The United Kingdom skincare is predicted to reach USD 24.37 billion by 2024.

- An estimated $7.7 billion was spent by beauty industries on advertising in 2022.

- Cosmetics industry statistics revealed the UK 2020 skincare market size to be worth £2.17 billion.

- Skincare is the second-largest branch of the beauty industry contributing to 23% of its revenue.

- In 2020, respondents in the UK aged 75 or above, spent an average of 8.20 British pounds weekly on personal care. Respondents aged 50 to 64 spent the most weekly with an average of 15.40 British pounds.

- In 2020, non-medicated facial goods were the UK's first choice of skincare products. Luxury skincare and gift boxes came second with over £537 million, body creams and lotion (over £200 million), and sunscreens (almost £167 million).

- The UK's skincare global market is dominated by major brands like Clarins, Unilever, L'Oréal S.A., and Procter & Gamble.

- Skincare products had the highest import value of cosmetics in 2019 at £1.81 billion.

Cosmetics Industry Statistics

The UK cosmetics market is prominent and one of the most dominating globally. The statistics for the cosmetic industry are shown below:

- The UK's organic cosmetics market is predicted to grow to £339 million by 2025.

- In 2021, 13% of UK adults either intended to or bought a beauty advent calendar for Christmas.

- Great Britain's toiletries and Cosmetics industry made sales of £8.7 billion in 2020, £580 million less than 2019.

- In 2020, toiletries led the market for cosmetics in the UK with a market share of almost 30%.

- Toothpaste products generated £538 million, which was the highest market value for the cosmetic toiletry sub-sector in 2020.

- The beauty market value of eyeshadows in the UK was estimated to be above £351 million in 2020.

- Imported and exported cosmetics value from and to the UK dropped in 2020 by 8 and 7% respectively.

- The biggest destination for beauty UK Cosmetics was the Irish Republic in 2020 with an import trade value of over £467 million.

- The cosmetic market is the third-largest market operating in the UK and the seventh-largest globally.

- 79% of men in Great Britain frequently used deodorants and shampoos as their most-used cosmetics products. The preferred cosmetics brands were Lynx and Head and Shoulders.

UK Beauty Industry Statistics vs USA Beauty Industry Statistics

The UK and the USA, have the highest impacts on the beauty industry. The statistics we've given show how these countries interact with this industry:

- The US organic and natural beauty market is projected to reach $54 billion by 2027.

- The UK's natural and organic beauty market is predicted to hit £339 million by 2025.

- The US beauty industry generated a revenue of $77,985 million in 2020.

- In 2020, the largest global skincare market was the US, bringing in $17.5 billion in revenue.

- As of 2020, the UK skincare market was worth £2.17 billion.

- Approximately 70% of US consumers between 18 and 29 years old prefer to use only natural, organic cosmetics.

- 45% of British consumers use at least 1 organic beauty product and 64% buy products with recyclable packages.

- Men in the USA spent over $6.9 billion on grooming products.

- Women in the US spend over $3,756 on beauty products annually.

- Hair Care products are the most used type of beauty products by women in the US and UK.

- Americans spend an average of $197.01 on beauty products.

- 19.33% of the British spend between £1 and £15 per month on beauty treatments and products.

UK Cosmetics Market Trends

Growing consumer awareness as well as the desire of cosmetics companies to switch out synthetic ingredients with natural ones—such as essential oils, oleoresins, vegetable saps and extracts, oils, fats, and waxes—has resulted in a significant demand for natural cosmetics products. These views have consequently led to a demand for natural components in cosmetics rather than chemicals that are linked to health hazards.

Online beauty consumers are becoming more and more interested in the ease of online buying, reading product reviews, exchanging online beauty tips, and getting automatic refills of frequently used items rather than just price and promotion. Consumer e-commerce generates over USD 120 billion in revenue annually and makes up 30% of the UK retail sector, up from 20% in 2020, according to the International Trade Association.

UK Cosmetics Market Analysis

Demand and supply chains for cosmetics and beauty products in the UK were impacted by the COVID-19 pandemic. The market did, however, return to normal after COVID-19 as the government removed the restrictions. Retail sales of pharmaceutical, medical, cosmetic, and bathroom goods in Great Britain, for example, rose by 10.2% in 2022 over 2021, according to the Office for National Statistics.

In addition, the UK experienced a rise in the market for hygiene products after the COVID. Nonetheless, the country's aging population is driving up demand for cosmetic anti-aging products, and the introduction of new, cutting-edge products in eco-friendly packaging is spurring the market's expansion.

How Big is the UK Beauty Industry?

In 2022, the UK health and beauty market was worth GBP39.04 billion. During the period 2022-2027, the market is estimated to grow at a CAGR of more than 2%.

The UK cosmetics boom took place in 2017 when the sector's market value hit an amazing 9.8 billion British pounds. This figure fell slightly in 2020 and 2021, owing primarily to the Covid-19 pandemic outbreak. Nonetheless, the United Kingdom was among Europe's top cosmetic users in 2021. Color cosmetics, one of the various sub-sectors within this industry, suffered a hit in 2020, falling by roughly 25% from the previous year.

How Much Is The UK Beauty Industry Worth 2023?

In 2023, the revenue in the UK Beauty & Personal Care market is expected to reach US$92,233,720,368,547,760.00. It is predicted to increase by 0.00% annually (CAGR 2023-2028).

The Beauty and Personal Care market is prospering and is one of the fastest-growing consumer markets, with the Cosmetics and Skin Care segments driving the majority of growth.

The generational change with young consumers joining the market is the primary reason for this rapid rise. At the same time, social media, internationality, and eCommerce all have a long-term impact on beauty product purchasing behavior. Global trends are spreading and altering the daily beauty and care regimen.

What Country has the Biggest Beauty Industry?

The market size of beauty & personal care in 20 countries worldwide in 2023: United States, China, Japan, India, Brazil, Germany, France, United Kingdom, Russia, South Korea, Italy, Bangladesh, Spain, Mexico, and Iran. Indonesia, Canada, Nigeria, Turkey, and Australia showed that the ranking by revenue in the beauty & personal care market is led by theUnited States with 98 billion U.S. dollars and is followed by China (67 billion U.S. dollars).

What Demographic Spends The Most On Beauty?

Despite being impacted by 8% during the pandemic, the beauty sector is booming and is expected to be valued at $688.89 billion by 2028. In terms of beauty industry spending per country, the United States spends the most - 89.7 billion USD each year and millennial women buy the most beauty items (38%).

Black women, in particular, spend an estimated $7.5 billion on beauty products yearly, spending 80% more on cosmetics and twice as much on skincare as non-Black women.

Final Notes

The UK beauty industry market size is rapidly evolving, and proof of this is evident in the beauty industry trends we have listed above.

We think reading them will help you stay informed as someone with ties to the beauty industry, whether you are a manufacturer, retailer, or consumer. Interested in any of our products?

Want press? Contact us.

Interested in any of our products? Check out our makeup mirrors and full length mirrors.

References:

- https://www.finder.com/uk/

- https://www.policybee.co.uk/

- https://fashiondiscounts.uk/

- https://dontdisappoint.me.uk/

- https://www.retailgazette.co.uk/

- https://professionalbeauty.co.uk/

- https://www.statista.com/

- https://www.mordorintelligence.com/

- https://www.retailgazette.co.uk/

- https://capitalcounselor.com/

- https://dealsonhealth.net/

- https://uk.fashionnetwork.com/news/

- https://faveable.com/

Liquid error (sections/article-template line 192): Invalid form type "28\n", must be one of ["product", "storefront_password", "contact", "customer_login", "create_customer", "recover_customer_password", "reset_customer_password", "guest_login", "currency", "activate_customer_password", "customer_address", "new_comment", "customer", "localization", "cart"]

Alicia Hollywood Mirror 60cmx80cm

Alicia Hollywood Mirror 60cmx80cm Angelina Full Length Arch Hollywood Mirror 160 x 60cm

Angelina Full Length Arch Hollywood Mirror 160 x 60cm Angled Luna Mirror-Cheval Black

Angled Luna Mirror-Cheval Black Angled Luna Mirror-Cheval Gray

Angled Luna Mirror-Cheval Gray