Are you curious about the state of the furniture industry in the UK?

We have curated and vetted the top furniture statistics you should know.

Top 10 Furniture Industry Statistics

There are the most interesting top furniture industry statistics:

- Revenue in the Furniture market amounts to US$252.90bn in 2023

- The market is expected to grow annually by 3.98% (CAGR 2023-2027)

- The market's largest segment is the segment Living Room Furniture with a market volume of US$70.61bn in 2023

- In 2021, 132.7 billion U.S. dollars amounted from retail e-commerce revenue from furniture and homeware sales and is projected to increase to over 208.2 billion U.S. dollars in 2025

- Sustainable and wellness-oriented office furniture is becoming the norm and the commercial furniture market is expected to have $59.82 billion in revenue by 2027

- The UK's furniture industry employed an average of 95,000 workers in 2019

- The value of the global furniture market was predicted to rise yearly to reach a value of about 650.7 billion dollars by 2027

- Furniture and home furnishing sales accounted for 11.78 % of total retail e-commerce sales in the United States

- People who have resided at their current address for five years or more make up about 40% of furniture buyers

- More than 70% of buyers don't have kids in the house; 47% have two adults living together without any kids, and 25% are households with just one adult.

UK Furniture Industry Statistics

- The global lockdowns implemented by governments in response to the coronavirus disease outbreak (COVID-19) had a significant negative impact on the UK home furnishings sector in 2020, disrupting supply chains and lowering consumption

- The majority of purchasers migrated to the online channel as governments and organizations restricted people's freedom to travel, which caused the online furniture sector to grow dramatically

- The need for competitively priced, space-efficient furniture is anticipated to increase as the population of the UK continues to grow and living standards rise

- The furniture has performed fairly well during the past five years. Over 45% of the demand is met by local production. With a fourth-place rating in Europe

- Due to the large presence of alternative channels such as e-commerce, hypermarkets, and department stores when compared to other European countries, the United Kingdom has the biggest share of non-specialist merchants in the furniture distribution industry

- Approximately 24.5 billion British pounds worth of furniture and furnishings were purchased by UK households in 2021

- In 2020, furniture manufacturing contributed approximately 3.22 billion British pounds to the GVA of the UK Non-Financial Business Economy

- In 2020, kitchen furniture manufacturers in the UK produced revenue of around 2.58 billion British pounds

- In 2021, UK manufacturers sold approximately four million items of metal office furniture

- In 2021, UK manufacturers sold approximately 5.58 million items of wooden bedroom furniture

Global Furniture Industry Statistics

- The industry data predicts an 11.9% annual growth, which should result in a $294 billion revenue in 2023

- In global comparison, most revenue is generated in the United States (US$252.90bn in 2023)

- Japan spent a much lower, but still impressive, sum of $13.4 billion

- Germany and the UK followed with $7.3 and $7 billion respectively

- Hence, the furniture market should grow to some 10 billion US dollars, based on the current Australian furniture industry stats

- With China and the US as the biggest online furniture purchasers, the current global furniture revenue is at about $190 billion

- With a €22 billion ($26.6 billion) turnover, Germany was the number one furniture producer in Europe in 2018

- Not only is Germany at the top of the furniture industry game, but the data also reveals that the country’s kitchen furniture has the highest export share at 38.9%.

- The pandemic’s sudden job losses have significantly affected the furniture industry. In November 2020, the industry unemployment rate was 6.7%

- The commercial furniture market is expected to have a CAGR of 7% from 2020 to 2027

- According to the office furniture industry statistics, eco-friendly furniture sales are expected to grow between 2020 and 2027

- According to U.S. furniture sales statistics in manufacturing, a standard office chair can currently support up to 300 lbs

- In 2021, retail e-commerce revenue from furniture and homeware sales amounted to 132.7 billion U.S. dollars and is projected to increase to over 208.2 billion U.S. dollars in 2025

- In the most recently measured period, furniture and home furnishing sales accounted for 11.78 percent of total retail e-commerce sales in the United States.

Challenges of the Furniture Industry

Due to the diversity of the furniture industry, distinct problems may occur for diverse producers based on their location and scale. But regardless of their size, location, or scope, the majority of the firms deal with the challenges outlined below problems.

1: Cost of Commodity

A persistent increase in the price of a commodity affects the company's overall bottom line because companies in this industry occasionally buy significant quantities of commodities at once.

2: Lack of resources

Suppliers frequently find themselves unable to supply manufacturers with enough material immediately, which requires them to postpone fulfilling customer orders until more is produced.

3: Transportation

Several furniture firms employ air freight to transport their products. There can be issues with timing and quality control because it has suddenly become so expensive.

4: Scarcity of funds

Banks are now lending less money than they once did, making it more difficult for larger businesses to compete with imports whose goods require local partners to market and sell in that area.

5: Insufficient skilled labor

Finding skilled candidates for managerial positions can be difficult for factory owners because there are so few educational institutions that provide degrees in industrial design and manufacturing sciences.

You may also be interested:

FAQ

Is there a high demand for furniture?

In 2021, 132.7 billion U.S. dollars amounted to retail e-commerce revenue from furniture and homeware sales and is projected to increase to over 208.2 billion U.S. dollars in 2025.

How big is the furniture industry?

Revenue in the Furniture market amounts to US$252.90bn in 2023

The market is expected to grow annually by 3.98% (CAGR 2023-2027)

Who dominates the furniture industry?

In world furniture production, China occupies 20%, the US has 19%, Italy has 8% share, while France, and the United Kingdom, among others, have a 3% share. In 2021, the United States was the world's largest market for furniture, with sales of about 227 billion dollars. Also, Germany and China, each of which have markets worth more than 50 billion dollars, placed second and third, respectively.

How big is the furniture market in the world?

The global market value of furniture was estimated to be 557 billion U.S. dollars in 2022 and was expected to increase every year to reach a forecasted value of approximately 650.7 billion U.S. dollars by 2027

Which is the largest furniture market in the world?

The office furniture market in the United States, which was valued at USD 14.0 billion in 2021 and is projected to increase at a compound annual growth rate (CAGR) of 5.3% from 2022 to 2030, is the largest in the world.

What percentage of furniture is sold online?

Statistics on online shopping for 2022 indicate a significant increase in volume.

According to information from the e-commerce business sector, sales of furniture and home decor will account for 14% of all sales in 2022. It is anticipated that online furniture sales will bring in $99.887 billion in revenue.

Who buys the most furniture?

Retail statistics for the furniture business show that Generation X is not far behind. In 2016, 32% of the market's consumers were members of Generation X. In 2018, their participation grew to 38%.

The most frequent buyers of bedding and furniture are typically millennials.

According to statistics on millennial purchasing, 35% of all furniture and bedding purchases in the US were made by millennials in 2016. Two years later, this percentage increased to 42%.

The rate at which they shop has changed more among baby boomers. They made up 33% of the second-largest buying cohort in 2016 but only 20% of US furniture shoppers in 2018, dropping them to third place.

How many furniture companies are there in the UK?

The total number of Furniture Companies UK is 39,282. London is the largest region with a 16% market share in the furniture industry (6,112).

Conclusion

According to statistics for the furniture sector, major changes have been occurring over the last few years. The market is expected to expand, and unemployment rates have decreased.

One of the many reasons furniture is so significant is that it can affect every aspect of a place. How people move around a room and how easily they can access important features. All of these are frequently shaped by the size and placement of furniture.

Liquid error (sections/article-template line 192): Invalid form type "75\n", must be one of ["product", "storefront_password", "contact", "customer_login", "create_customer", "recover_customer_password", "reset_customer_password", "guest_login", "currency", "activate_customer_password", "customer_address", "new_comment", "customer", "localization", "cart"]

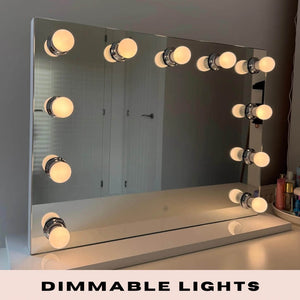

Alicia Hollywood Mirror 60cmx80cm

Alicia Hollywood Mirror 60cmx80cm Angelina Full Length Arch Hollywood Mirror 160 x 60cm

Angelina Full Length Arch Hollywood Mirror 160 x 60cm Angled Luna Mirror-Cheval Black

Angled Luna Mirror-Cheval Black Angled Luna Mirror-Cheval Gray

Angled Luna Mirror-Cheval Gray