The beauty industry thrives on transformation, confidence, and helping clients look and feel their best. Behind every perfect manicure, flawless facial, or stunning hair transformation lies a professional who has invested years in training, building their skills, and establishing their reputation. However, while beauticians focus on enhancing their clients' appearance, there's something important they often overlook – the hidden risks that could transform their thriving business into a financial nightmare.

Working in the beauty industry might seem relatively low-risk compared to other professions, but the reality is quite different. Every treatment carries potential complications, every client interaction presents liability risks, and every day brings new challenges that could result in costly claims. Understanding these risks and protecting against them isn't just smart business practice – it's essential for long-term success.

The Hidden Risks Behind Beauty Treatments

The daily reality of working as a beautician involves exposure to numerous risks that many professionals don't fully appreciate until something goes wrong. From the products applied to clients' skin to the equipment used in treatments, each aspect of a beauty service carries potential liability.

Treatment Complications and Allergic Reactions

Even the most experienced beauticians can encounter unexpected situations. Allergic reactions to beauty products, chemical burns from treatments, or adverse reactions to procedures can occur despite following all proper protocols. When a client suffers an allergic reaction to a facial treatment or develops a skin condition following a procedure, they may seek compensation for medical costs, lost income, and emotional distress. Without proper insurance cover, beauticians could find themselves personally liable for thousands of pounds in damages.

Consider the case of a client who develops severe dermatitis following a chemical peel. Despite the beautician following standard procedures and conducting patch tests, the client's reaction results in scarring that requires medical treatment and time off work. The resulting claim could easily exceed £10,000 when medical costs, compensation, and legal fees are factored in.

Equipment Failures and Property Damage

Modern beauty treatments often rely on sophisticated equipment, from laser devices to steamers and electrical tools. When this equipment malfunctions, the consequences can be severe. A faulty waxing pot could cause burns, a malfunctioning facial steamer might damage a client's skin, or electrical equipment could cause injuries or property damage.

Beyond equipment failures, simple accidents can have expensive consequences. Spilling hair dye on a client's expensive clothing, accidentally damaging jewellery during a treatment, or causing water damage to a client's property during a mobile service visit can all result in compensation claims that quickly mount up.

Professional Negligence Claims

The beauty industry is built on trust, expertise, and professional standards. When clients believe they haven't received the standard of care they expected, or when treatments don't meet promised outcomes, professional negligence claims can follow. These claims can arise from various situations, including improper technique, failure to provide adequate aftercare advice, or misrepresentation of treatment benefits.

Professional negligence claims are particularly complex because they often involve subjective assessments of treatment quality and outcomes. Legal costs alone can be substantial, even when claims are ultimately unsuccessful, making professional indemnity insurance an essential protection for beauty professionals.

Mobile and Freelance Specific Risks

Mobile beauticians and freelance professionals face additional risks that salon-based practitioners might not encounter. Travelling between appointments means increased exposure to accidents, while working in clients' homes presents unique liability challenges. Damage to a client's property, injuries occurring in unfamiliar environments, or accidents during travel can all result in costly claims.

The rise of freelance beauty professionals has created new insurance challenges. Unlike salon employees who may be covered under their employer's insurance, independent practitioners must arrange their own comprehensive cover that addresses the full range of risks they face.

Why Standard Insurance Falls Short

Many beauticians assume that basic public liability insurance provides adequate protection, but the reality is far more complex. The beauty industry involves unique risks that require specialist cover designed specifically for these challenges. Standard insurance policies often contain exclusions that leave beauty professionals exposed to significant financial risks.

Treatment-Specific Exclusions

Many general insurance policies exclude or limit cover for beauty treatments, particularly those involving chemicals, heat, or cosmetic procedures. This means that claims arising from the core activities of a beauty business might not be covered under standard policies. Specialist beauty insurance is designed to understand and cover these specific risks without the extensive exclusions found in general policies.

Professional Standards and Regulations

The beauty industry is subject to specific regulations and professional standards that impact insurance requirements. Specialist insurers understand these requirements and design policies that align with industry standards, ensuring that cover meets both legal requirements and professional best practices.

Product Liability Considerations

Beauty professionals often recommend and sell products to clients, creating product liability exposures that standard insurance might not adequately address. When clients suffer adverse reactions to recommended products or when products fail to deliver promised results, beauty professionals can face claims that require specialist cover to address properly.

The True Cost of Being Uninsured

Operating without adequate insurance cover exposes beauty professionals to potentially devastating financial consequences that extend far beyond the immediate costs of claims. Understanding these risks helps illustrate why specialist insurance represents essential business protection rather than optional expense.

Direct Financial Impact

Uninsured claims can quickly escalate to tens of thousands of pounds when medical costs, compensation, and legal fees are considered. A serious allergic reaction requiring medical treatment and resulting in lost income for the client could easily result in a claim exceeding £20,000. For most beauty professionals, such costs would represent a significant portion of annual income and could threaten business viability.

Business Continuity Risks

Beyond immediate financial costs, insurance claims can disrupt business operations and damage professional reputations. Clients may lose confidence in practitioners who face publicised claims, leading to reduced bookings and income loss that extends far beyond the original incident.

For mobile professionals or those operating from rented premises, insurance claims could also result in losing access to venues or having operating restrictions imposed that limit business activities. Some venues require proof of insurance before allowing beauty professionals to operate on their premises, making adequate cover essential for maintaining business operations.

Personal Financial Exposure

Many beauty professionals operate as sole traders or through limited companies with minimal assets, leading them to believe they have little to lose from uninsured claims. However, successful claimants can pursue personal assets, including homes and savings, when business assets are insufficient to meet claim costs.

Choosing the Right Cover

Selecting appropriate insurance cover requires careful consideration of individual business risks, treatment types, and operating models. Beauty professionals should work with insurers who understand industry-specific risks and can provide tailored cover that addresses their particular circumstances.

Assessing Individual Risk Profiles

Different beauty treatments carry varying levels of risk, and insurance cover should reflect these differences. Professionals offering chemical treatments, heat-based therapies, or invasive procedures require more comprehensive cover than those providing basic beauty services. Similarly, mobile professionals face different risks than salon-based practitioners and need cover that addresses travel and location-specific exposures.

Understanding Policy Terms and Exclusions

Insurance policies contain detailed terms and conditions that significantly impact cover effectiveness. Beauty professionals should carefully review policy exclusions to ensure that their core business activities are covered without excessive limitations. Common exclusions might relate to specific treatment types, geographical restrictions, or operational requirements that could impact cover validity.

Planning for Business Growth

Insurance requirements often change as beauty businesses evolve and expand. Practitioners who begin with basic treatments might later incorporate more advanced procedures that require enhanced cover. Similarly, professionals who start working from home might later establish commercial premises or begin mobile operations that create new insurance requirements.

The Professional Advantage

Carrying appropriate specialist insurance provides beauty professionals with significant competitive advantages that extend beyond basic financial protection. These benefits can help build client confidence, access new opportunities, and establish professional credibility that supports business growth.

Building Client Confidence

Clients increasingly expect beauty professionals to carry comprehensive insurance cover, viewing it as a sign of professionalism and competence. Being able to demonstrate adequate insurance cover can help win new clients and provide existing clients with confidence that they're working with a responsible professional who takes their obligations seriously.

Many clients specifically ask about insurance cover before booking treatments, particularly for higher-risk procedures or when visiting new practitioners. Having appropriate cover in place enables beauty professionals to respond confidently to these enquiries and demonstrate their commitment to professional standards.

Access to Premium Venues and Opportunities

Many high-end venues, spas, and event locations require beauty professionals to demonstrate comprehensive insurance cover before allowing them to operate on their premises. This requirement extends to corporate events, wedding venues, and premium salon rental opportunities that can provide access to affluent client bases.

Professional insurance cover can also be required for participation in trade shows, professional exhibitions, and collaborative opportunities with other businesses. Having appropriate hair salon insurance cover ensures that beauty professionals can take advantage of these opportunities without being excluded due to inadequate protection.

Moving Forward with Confidence

The beauty industry continues to evolve, with new treatments, technologies, and client expectations creating both opportunities and challenges for professionals. Navigating this environment requires not just technical skills and business acumen, but also comprehensive protection against the various risks that come with serving clients in such a personal and visible industry.

Specialist insurance cover provides the foundation for confident professional practice, allowing beauty professionals to focus on what they do best – helping clients look and feel their best – without worrying about the potential financial consequences of unexpected incidents or claims. This protection becomes even more valuable as businesses grow and evolve, providing the security needed to take advantage of new opportunities and expand service offerings.

Taking the time to properly assess insurance needs and arrange appropriate specialist cover represents an investment in professional success that pays dividends through enhanced client confidence, access to better opportunities, and the peace of mind that comes from knowing your business is properly protected against whatever challenges might arise.

Liquid error (sections/article-template line 192): Invalid form type "53\n", must be one of ["product", "storefront_password", "contact", "customer_login", "create_customer", "recover_customer_password", "reset_customer_password", "guest_login", "currency", "activate_customer_password", "customer_address", "new_comment", "customer", "localization", "cart"]

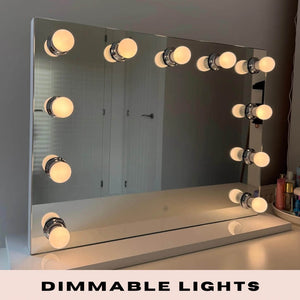

Alicia Hollywood Mirror 60cmx80cm

Alicia Hollywood Mirror 60cmx80cm Angelina Full Length Arch Hollywood Mirror 160 x 60cm

Angelina Full Length Arch Hollywood Mirror 160 x 60cm Angled Luna Mirror-Cheval Black

Angled Luna Mirror-Cheval Black Angled Luna Mirror-Cheval Gray

Angled Luna Mirror-Cheval Gray